Easy ways to increase your credit score to better your finances.

4 min read

Many of us are guilty of thinking the more money you have, the better your finances are and whilst this can be true for some, your credit score could be holding you back. All the money in the world can’t fix a bad credit score and being unable to stick to the rules of credit agreements can have a detrimental effect on your financial life. Your credit score is a key factor in making your money more manageable when it comes to taking out loans and finance. There are many ways in which a good credit score can benefit you so we look at why it’s important and also a few easy steps you can take to better your credit.

Why is a good credit score better?

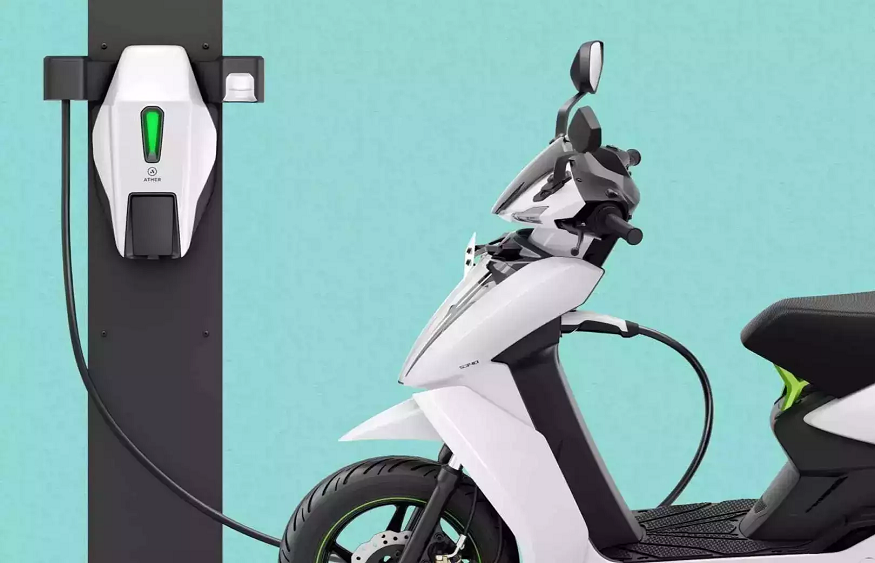

A good credit score can have a big impact on your financial life. Not only can you see easier acceptances when applying for car loans, mortgages, personal loans and even moped finance, you can also receive a better interest rate too. Interest rates affect the cost of borrowing, and a higher rate can make borrowing money more expensive than it needs to be. A better credit score can also give you access to higher credit limits on credit cards and even more opportunities for renting a property if the landlord requires a soft search credit check to be performed.

Ways to easily boost your credit score.

Increasing your credit score can take time and effort but creating new financial habits can have a massive impact on your financial health. It can be worth taking some time to consider the following and taking some time to work on your score before you apply for any new finance or credit.

1. Check your credit file for any mistakes.

You should get into the habit of checking your credit score regularly and when you do, it’s important that all the info listed on your file is accurate and up to date. Information that is inaccurate can be negatively impacting your score so you should check that all your personal information is correct and take a look at the applications you’ve made for credit to make sure they all look right. If not, you could have been the victim of a fraudulent application in your name.

2. Remove any negative associations from your credit report.

When you check your report, you will also be able to see if you have any financial links with anyone else. A financial link on your credit report may happen when you take out finance together such as a guarantor loan or joint finance deal on a car. If the person you are linked to has bad credit, it can be negatively impacting your score too. Its best to ask the credit referencing agency to disassociate them from your credit file if you no longer have any active credit together.

3. Make payments on time and in full.

One of the best ways to prove your creditworthiness is to keep on top of your current credit repayments. Making payments on time and in full is an easy way to increase your credit score and stick to the rules of your agreement. Missing payments can have a detrimental effect on your credit and can also lead to more serious financial consequences such as defaults, CCJs and even bankruptcy. Good credit management can help to show future lenders that you can be trusted to pay back your finance and can improve your score along the way.

4. Reduce any existing debt you have.

Your credit score is calculated by a number of factors and one of those factors is how much of your available credit you’re using. Having high levels of debt can have a negative impact on your credit and it can put lenders off as they may think you’re struggling to keep on top of the credit you already have. Where possible, you should try to reduce any existing debt you have first before taking on anymore.

5. Use your credit little and often.

The creditutilisation ratio is used by lenders to assess how much credit you have. The credit utilisation ratio recommends that you only use a small amount of credit but keep using it often and pay it off in full. You should try to only use around 50% of your credit limits on each account and if you really want to maximise your score, consider using under 30% of your limit.

6. Register on the electoral roll.

The electoral roll in the UK is a list of all the people who are eligible to vote and whilst it can’t directly improve your score, it can be an easy way to verify your identity. Your credit report states whether or not you are on the electoral roll and lenders can use it to verify your identity.